|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

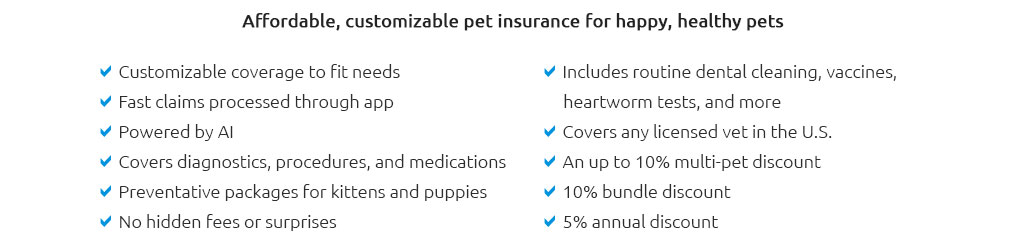

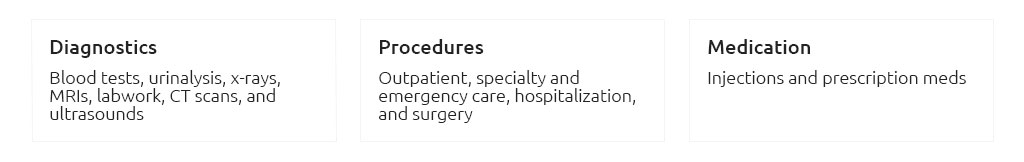

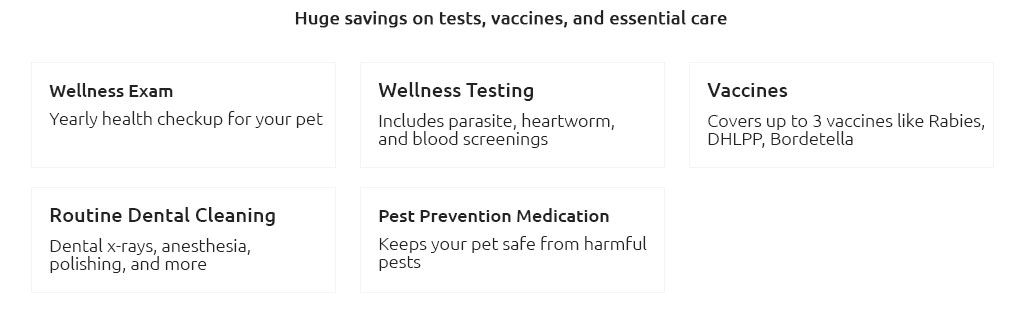

The Best Dog Insurance: A Comprehensive GuideWhen it comes to our four-legged companions, ensuring their health and well-being is a top priority. As veterinary costs continue to rise, many pet owners find themselves contemplating the merits of dog insurance. However, with a myriad of options available, choosing the best dog insurance can feel overwhelming. In this guide, we aim to provide a balanced analysis to aid in your decision-making process. Understanding Dog Insurance Dog insurance, much like human health insurance, is designed to cover medical expenses arising from accidents, illnesses, and sometimes even routine care. Policies vary significantly, offering different levels of coverage, premium costs, and deductibles. It’s crucial to dissect these elements to find a plan that aligns with your needs and budget. Key Benefits of Dog Insurance Financial Security: Perhaps the most compelling reason to invest in dog insurance is the financial security it offers. Veterinary treatments can be unexpectedly costly, especially in emergencies. A robust insurance policy can mitigate these expenses, allowing you to focus on your pet's recovery without financial strain. Comprehensive Coverage: Many policies offer extensive coverage that includes not just accidents and illnesses, but also hereditary conditions, alternative therapies, and behavioral treatments. This breadth of coverage ensures that your pet receives the best possible care throughout their life.

Potential Drawbacks Cost: The primary downside of dog insurance is the cost. Premiums can be high, especially for comprehensive plans, and may increase as your pet ages. It’s important to weigh these costs against the potential savings on veterinary bills. Exclusions: Many insurance plans have exclusions, such as pre-existing conditions or breed-specific issues, which can limit coverage. Reading the fine print is essential to avoid unpleasant surprises. Choosing the Right Plan When selecting a dog insurance plan, consider factors such as your pet’s age, breed, and existing health conditions. Younger dogs may benefit from plans with preventive care options, while older dogs might require coverage for chronic conditions. Researching and comparing different providers is crucial; look for reviews from other pet owners and consult with your veterinarian for recommendations. In conclusion, while dog insurance is not a one-size-fits-all solution, it can be a wise investment for many pet owners. By carefully evaluating your options and considering both the benefits and drawbacks, you can choose a policy that ensures your beloved pet receives the best possible care without breaking the bank. https://www.marketwatch.com/guides/pet-insurance/pet-insurance-washington-state/

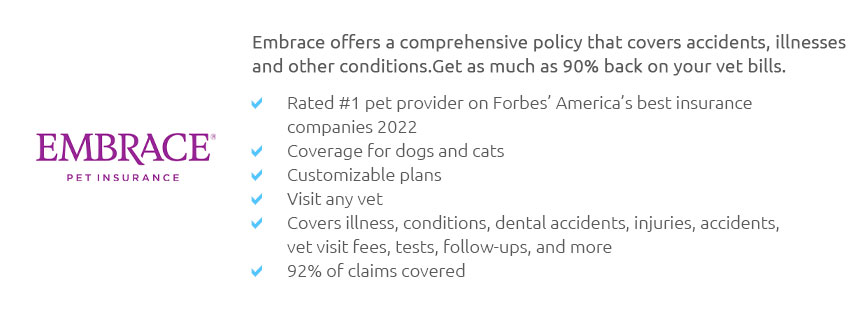

The Best Pet Insurance in Washington - Lemonade: Our top pick - Embrace: Best for multiple pets - ASPCA Pet Health Insurance: Best for senior ... https://www.aspcapetinsurance.com/

One of the most extensive plans on the market ; Accident Only Plan, Yes, No ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

The best pet insurance companies at a glance - ASPCA: Best for broad coverage. - Embrace: Best flexible wellness plan. - Hartville: Best for ...

|